SCOTT AND WHITE EMPLOYEE CREDIT UNION

$68 Million

Scott & White Employees Credit Union (SWECU) was chartered in 1962 by the employees of Scott & White. The credit union is state chartered and regulated by the Texas Credit Union Department. Along with the employees of Baylor, Scott and White and its affiliates, SWECU is open to anyone who resides, works, attends school, owns a business, or worships in Bell County, Texas. As of the 2010 census, Bell County’s population was 310,235.

December 2020 - December 2021 |

||

|---|---|---|

|

Share Growth

|

+11.02% | |

|

Asset Growth

|

+11.32% | |

|

Website Unique Visitors

|

+96% (Jan. 2021 - Dec. 2021 | |

|

Website Page Views

|

+94% (Jan. 2021 - Dec. 2021) | |

|

Social Media Audience Growth

|

+43% | |

PRODUCTS AND SERVICES

SWECU went live with an OMNICOMMANDER website in November 2017 in an effort to better serve its community with a gorgeous new digital branch. Their communication efforts were furthered as they built a social media presence starting in January of 2019 and then moved into a fully outsourced marketing partnership with the COMMANDOS in January of 2020.

Website

Outsourced Marketing

Social Media

Email Drip Campaigns

CAMPAIGN CREATION AND COLLATERAL

The partnership reached an all-new high with the creation and launch of their new marketing campaign, Live Freely. Debuting July of 2020, Live Freely messaging is focused on membership. Don't live a life of "what ifs." Live your life to the fullest!

EMAIL DRIP CAMPAIGNS

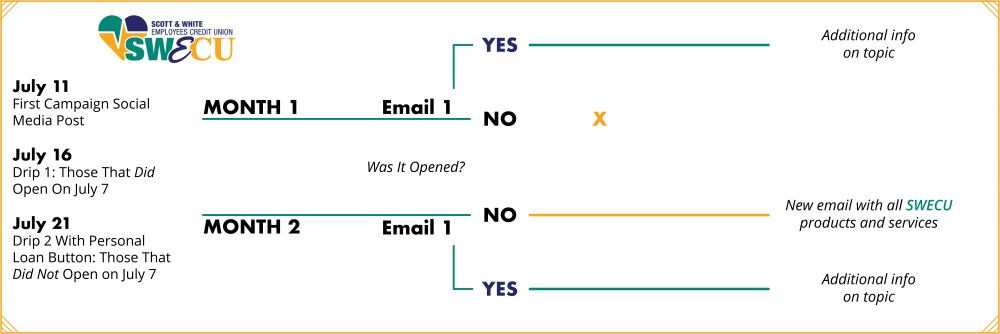

Automated drip emails were designed to learn more about SWECU members and the types of products they were interested in. SWECU members were segmented based on the actions taken from the email into smaller groups with similar interests.

A drip campaign was implemented over the course of two months. As a result of the campaign, the necessary data was gathered to better direct email recipients with a more positive result. In SWECU's case, this was the Borrowing Services tab of their website.

The implementation of this drip campaign gave SWECU the ability to focus their marketing strategy to direct traffic to their loans information. This insight, in conjunction with the launch of integrated marketing efforts, has had a direct impact on the credit union with increased form conversion rates by continuing to present helpful information to the members.

HIGHLIGHTS

Considering the extreme challenges that 2020 has presented, any growth would be a cause for celebration, but SWECU has had above-average growth in three key metrics.